Introduction: The Strategic Shift to Digital Invoicing in the UAE

The United Arab Emirates’ e-invoicing initiative represents more than a regulatory update; it is a significant and strategic step in the nation’s broader digital transformation and tax modernisation journey. This mandate is designed to create a more transparent, efficient, and real-time digital tax ecosystem, shifting the landscape from traditional paper-based processes to a fully integrated digital framework.

At its core, “e-invoicing” refers to the process of issuing, receiving, and storing invoices in a structured digital format, which is fundamentally different from exchanging paper documents or simple PDF files. This system allows for the direct and automated exchange of invoice data between businesses and, crucially, with the tax authorities. The primary benefits for the tax system as a whole are a reduction in manual work, a significant improvement in data accuracy, and enhanced compliance with tax regulations.

This transition is underpinned by a clear legal framework established by Federal Decree-Law No. 16 of 2024 and Federal Decree-Law No. 17 of 2024, alongside Ministerial Decisions No. 243 and 244 of 2025. Together, these regulations provide a comprehensive roadmap, defining the scope, implementation timeline, and compliance obligations for businesses. Understanding this framework is the essential first step for any organisation to ensure compliance and successfully leverage the benefits of this new digital system.

Deconstructing the UAE E-Invoicing Model: The 5-Corner Framework

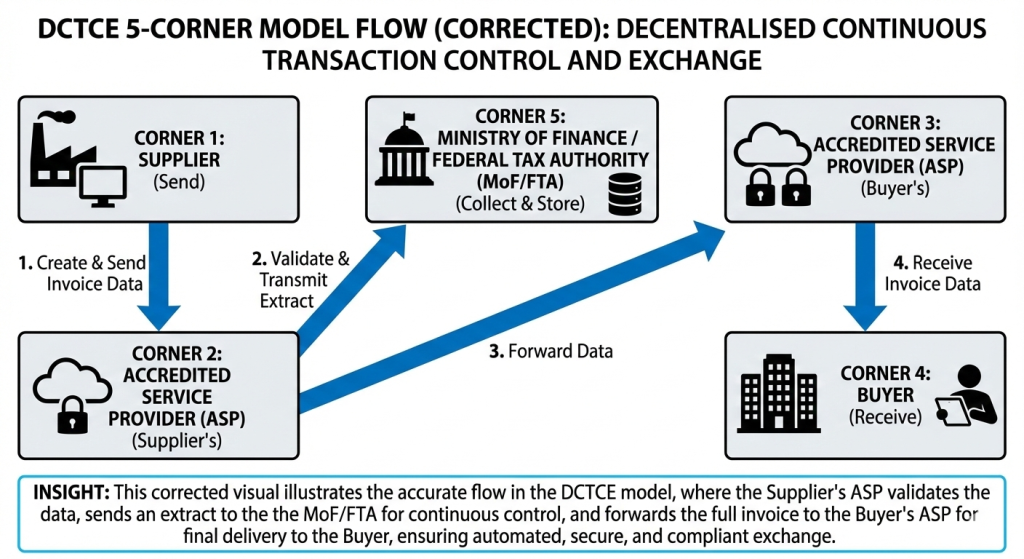

The UAE has adopted a “Decentralised Continuous Transaction Control and Exchange (DCTCE)” model for its e-invoicing system. This sophisticated “5-corner” framework clearly defines the roles and interactions between the key participants: the supplier (seller), the buyer, their respective service providers, and the tax authorities. It ensures that invoice data is validated, transmitted securely, and reported to the government in near real-time.

The transaction flow is meticulously structured across five distinct “Corners”:

- Corner 1: Send – The process originates with the supplier, who enters invoice data into their business software. This data is then sent to their OpenPeppol Accredited Service Provider (SP) for processing.

- Corner 2: Validate & Transmit – The supplier’s SP performs several critical functions. It validates the invoice data to ensure technical standards are met, confirms the buyer’s identity via a central directory, sends the invoice securely through the OpenPeppol network, and simultaneously reports relevant data to the tax authorities.

- Corner 3: Collect & Deliver – The buyer’s designated SP receives the structured invoice data from the network and delivers it directly into the buyer’s business software in their preferred format.

- Corner 4: Receive – In the final step for the business-to-business transaction, the buyer’s software receives the validated, structured invoice data from their SP, enabling automated processing.

- Corner 5: Collect & Store – This corner represents the government oversight function. Accredited Service Providers send an extract of relevant invoice data to the Ministry of Finance (MoF) and the Federal Tax Authority (FTA) for compliance and storage.

The responsibilities of the key entities within this framework are clearly delineated:

| Entity | Role & Responsibility |

| Ministry of Finance (MoF) | Responsible for the overall governance of the system and the certification of Accredited Service Providers (ASPs). |

| Federal Tax Authority (FTA) | Responsible for ensuring business compliance with the e-invoicing mandate and its subsequent enforcement. |

| Accredited Service Provider (ASP) | A third-party provider, certified by the MoF, that facilitates the validation, secure transmission, and official reporting of e-invoices on behalf of businesses. |

| Businesses (Suppliers/Buyers) | Required to use the e-invoicing system for all applicable transactions by connecting to it via a certified ASP. |

With the mechanics of the system now clear, the next critical step for any business is to determine if and when they fall under the mandate’s scope.

Scope and Applicability: Will Your Business Be Affected?

The e-invoicing mandate has a broad scope, applying to all persons conducting commercial transactions in the UAE. This includes non-resident entities engaged in business within the country and covers all business-to-business (B2B) and business-to-government (B2G) transactions, regardless of whether the entities involved are registered for VAT.

However, Ministerial Decision No. 243 of 2025 outlines specific exclusions from the mandate. The following are not currently required to use the e-invoicing system:

- Government entities performing sovereign functions that are not in commercial competition.

- International passenger transportation services provided by an Airline via an Aircraft, where an Electronic Ticket is issued to the passengers.

- Any services provided directly to the passengers by an Airline, that are ancillary to the services mentioned above, where an Electronic Miscellaneous Document is issued for such services.

- International transportation services in respect of goods, provided by an Airline, where an Airway Bill is issued. (Note: this is a temporary exclusion that will apply for only 24 months from the system’s effective date.)

- Financial services that are either exempt or zero-rated under the UAE VAT law.

- Any other business transactions that may be designated for exclusion by the Minister in the future.

It is important to note that Business-to-Consumer (B2C) transactions are not currently subject to the e-invoicing system. Any person engaged exclusively in B2C transactions will not be required to comply until a future decision on the matter is issued by the minister.

Once a business confirms its inclusion within the mandate’s scope, the immediate priority becomes understanding the official implementation timeline to prepare accordingly.

The Phased Rollout: A Timeline for Mandatory Implementation

The UAE has adopted a strategic, phased rollout for the e-invoicing system. This approach serves two key purposes: it allows for thorough testing and refinement of the system through a pilot program, and it provides businesses of different sizes and complexities a clear, tiered timeline to prepare their systems, processes, and personnel for the transition.

The implementation schedule is structured with key deadlines for appointing an Accredited Service Provider (ASP) and going live on the system:

| Phase | Key Group | Deadline to Appoint ASP | Deadline to Implement System |

| Pilot Program | Selected Taxpayer Working Group | (Starts July 1, 2026) | (Starts July 1, 2026) |

| Voluntary | Any Business | (Starts July 1, 2026) | (Starts July 1, 2026) |

| Mandatory: Wave 1 | Large Businesses (Revenue ≥ AED 50m) | July 31, 2026 | January 1, 2027 |

| Mandatory: Wave 2 | Smaller Businesses (Revenue < AED 50m) | March 31, 2027 | July 1, 2027 |

| Mandatory: Wave 3 | Government Entities | March 31, 2027 | October 1, 2027 |

Following these initial waves, all other remaining businesses and government entities subject to the system will be required to appoint an ASP and implement the e-invoicing system.

Meeting these deadlines requires a clear understanding of the specific compliance duties and operational changes that the new system demands.

Core Compliance Duties and Operational Impacts

The e-invoicing mandate will have a direct and significant impact on a company’s daily operations and compliance procedures. Adherence goes far beyond simply sending invoices electronically; it necessitates specific process adjustments and deep technical integration with the national system.

The primary compliance requirements for businesses are:

- Connect with a Certified ASP: All businesses subject to the mandate must engage an Accredited Service Provider that has been officially certified by the Ministry of Finance.

- Notify ASP of Data Changes: Businesses must notify their appointed Accredited Service Provider of any changes to their registered data within five business days of receiving confirmation of the amendment from the Authority.

- 14-Day Issuance Window: All Electronic Invoices and Electronic Credit Notes must be issued and transmitted through the system within 14 days of the date of the business transaction.

- Credit Note Issuance: An Electronic Credit Note must be issued in specific scenarios, including when a transaction is cancelled, the agreed consideration is reduced, the consideration is returned in full or part, or an administrative or numerical error has occurred.

- Data Access for Authorities: Businesses must be aware that the Federal Tax Authority will have the power to access and use any data that is processed, received, and stored within the Electronic Invoicing System for compliance purposes.

The mandate also introduces specific operational protocols for more complex transaction types:

- VAT Groups: For businesses operating within a VAT group, each group member must have its own unique endpoint connected through a UAE-accredited SP. Although invoices should include the group’s TRN, the endpoint must correspond to the specific member responsible for the transaction.

- Exports and Foreign Buyers: When transacting with a foreign buyer registered on the global Peppol network, their endpoint must be used. If the buyer is not on the network, a dummy endpoint is used for reporting purposes to the FTA (Corner 5). In this case, the invoice is not transmitted via Peppol, and the seller remains responsible for sending the invoice to the buyer through external means, such as email.

- Self-Billing: In self-billing arrangements, the process is reversed. The buyer generates the e-invoice, sends it to the supplier for their records, and simultaneously submits it to the FTA through their own accredited service provider.

These changes are part of a larger strategic move that, while requiring initial adaptation, promises significant long-term benefits.

Conclusion: The Strategic Imperative for Early Preparation

The implementation of the UAE’s e-invoicing system marks a fundamental shift from traditional invoicing to a fully integrated, data-driven digital framework. This is not merely a technical upgrade but a strategic transformation of the nation’s tax compliance and business transaction environment.

For businesses, the primary impacts are clear: the mandatory engagement with Accredited Service Providers, the establishment of a direct reporting line to tax authorities (MoF/FTA), and the critical need to adapt internal financial and IT processes to meet strict timelines and new technical standards.

Proactive and early preparation is therefore a strategic imperative. Businesses that begin their transition journey now will not only ensure they meet their compliance obligations smoothly but will also be best positioned to capitalise on the inherent advantages of the new system. The long-term benefits of automation, improved data accuracy, and enhanced operational efficiency are substantial, placing early adopters at the forefront as the UAE continues to advance its world-class digital tax ecosystem.

Looking for clarity on UAE tax compliance? Reach out to Imperium today and let’s simplify it together to stay compliant and stay confident—contact us now for tailored taxation and accounting solutions.